Each year as the first – and notoriously rigorous – term comes to a close, the Career Development Office (CDO), in conjunction with student clubs, organizes multiple Career Treks. The Treks offer a unique opportunity for first-year students to travel as a group, visiting sought after companies and speaking with key employees. So far, over 70% of the Class of 2015 has gone on one of three Career Treks; Marketing, Finance (both in New York), and Consulting (Boston). In the next few weeks, students, as well as the CDO, will share their experiences.

Finance Trek (New York City)

Deirdre O’Donnell spent 24 years of her career at Lehman Brothers in the Fixed Income Division, gaining experience as a trader, salesperson and manager. She became involved in Lehman’s campus recruiting effort at colleges and universities and ultimately became Global Head of Diversity Recruiting for the firm. After leaving Lehman in 2008 she joined the Tuck School of Business as an Associate Director of the Career Development Office, focusing on the financial services industry, including insurance and private equity.

First-year students just completed the annual “Wall Street Trek” to New York. Over three days, forty-three students visited BMO, Bank of America Merrill Lynch, Barclays, Citi, Goldman Sachs, JP Morgan, Morgan Stanley, and UBS. Although each visit was about two hours long, each was structured differently; networking, panel discussions, cocktails, and educational sessions. It was a great way for students to network with Tuck alumni in investment banking, from C-Suite executives to Associates. They returned to Hanover with a greater understanding of the industry and the “culture” of each firm. This month we will be returning to New York with students interested in Private Wealth Management and private banking to visit another division at the banks.

Anand is a first-year student at the Tuck School of Business at Dartmouth College. Prior to business school, he spent four years working in Belgium, France, and Turkey in various techno-economic roles. During his time in Belgium, Anand also liaised with the European Commission on Financial Exploitation and Business Modeling activities within the €600m European Future Internet Public-Private-Partnership Program. Anand is a computer science engineer by training and Indian by nationality.

Transformational experiences are common at Tuck. From learning managerial economics to playing tripod hockey, supporting animal shelters in the Upper Valley and recruiting at investment banks – all of us are exposed to transformation in one way or the other. As an international student with a non-finance background, recruiting for investment banking has transformed the way I perceive Tuck, its community, its curriculum, and my career after business school.

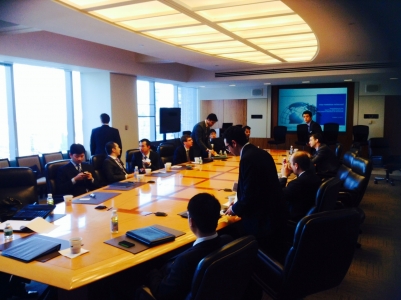

Last week, about 40 of us embarked on our maiden voyage to Wall Street. Over the course of three days, we visited a broad range of bulge-bracket and boutique banks, interacted one-on-one with Tuck alum across ‘The Street’, and revived ourselves from the Fall A overhang. The Career Development Office (CDO) went out of its way to plan, negotiate, and operationalize the trek. Banks were pre-selected to match our diverse professional backgrounds, post-MBA coverage preferences, and affinity for Tuckies within each bank.

One of the most valuable elements of the trek emerged from our interactions with Tuck alumni across Wall Street. We all knew Tuck’s alumni network was strong and well-connected, but it was during the Wall Street trek that we realized how invested Tuck alumni are in their alma mater. In spite of their busy schedules, many found time to share their experiences working on Wall Street. They also introduced us to colleagues at their respective banks. Most importantly, the alumni patiently listened to our reasons for pursuing investment banking as a career and gave valuable feedback on our pitch. For career changers (many T’15s), receiving frequent and candid feedback was immensely helpful in recalibrating and improving our investment banking pitch. Having made personal contacts with Tuck alums on The Street, many of us are now reaching out to their colleagues in the bank to better understand the subtle nuances of working within product vs. coverage groups, the value of pool vs. generalist placements, and overall culture with the banks. Indeed, cultural fit is probably the most important factor to everyone here at Tuck.

Another valuable element of the trek was the level of exposure we received during the span of three days. For instance, we had one-to-one interactions with Chris Ventresca - Global Co-Head of Mergers & Acquisitions at JPMorgan Chase and Michael McIvor - Vice Chairman of Americas Mergers & Acquisitions at Bank of America-Merrill Lynch. We had multiple opportunities to interact with Senior Partners from Goldman Sachs and Managing Directors at Barclays, UBS, Citi, and Morgan Stanley. Talking to senior leadership at these banks, we were able to gain an appreciation for the challenges and opportunities that lie ahead for investment banking.

Overall, we visited Goldman Sachs, JP Morgan, Barclays, UBS, BAML, Morgan Stanley, BMO Capital, and Citi in three days. Barclays graciously accommodated us at Oceana for late evening drinks, while some of us went out for dinner with alumni at JP Morgan. In addition, a handful of T’15s stayed over the weekend to meet other banks, and some individually scheduled meetings with specific coverage groups. Now that we have returned to Hanover, we’ve been able to initiate informational interviews with bankers we met during the trek.

This week, JP Morgan and Goldman Sachs revisited Tuck for “IB boot camp” and the Senior Speaker Series respectively. Next week, we have boot camp with Goldman Sachs and office hours with Barclays. Things are picking up now. Will keep you posted.