By Avi Sethi T'16

By Avi Sethi T'16

Avi is a first-year student at Tuck who previously worked for the NewSchools Venture Fund, a Palo Alto based ed-tech seed investor. Previous to NewSchools, he worked in strategy consulting at Accenture based out of New York City. He started his career as a high school math teacher in Charlotte, NC through the Teach for America program. Avi is a proud Minnesota Golden Gopher alum.

One of my fraternity brothers recently got back to the U.S. after spending the past three and a half months backpacking across South East Asia (amazing, right?!). While catching up, he asked me how business school was going. Hoping to talk more about his trip, I was vague and said, “It’s great!” Unsatisfied, he pushed me further: “Describe in detail what you did this past week.” Accepting his challenge, I opened up my iPhone’s calendar app and walked him through step-by-step, only to realize that, while it was a pretty typical week, there were some highlights that had made it pretty special and displayed the “fabric of Tuck” in ways that are usually difficult to describe.

Monday

My first class was Corporate Finance. While any Monday can be hard to wake up for, this Monday was particularly hard given that Tuck Winter Carnival took place that past weekend. Winter Carnival is an event hosted by Tuck that brings students together from over 15 business schools to enjoy an 80s-themed ski weekend at a nearby ski area.

Luckily, today’s class featured a prominent guest speaker, Tim Koller from McKinsey & Company, who wrote a book on valuation. I also woke up to a string of emails as an interview I did with a reporter from The Dartmouth, Dartmouth’s student newspaper, was featured in Monday’s edition!

This was our last full week of classes before finals and then spring break. Over break, I will be traveling to Japan for a Tuck-sponsored Global Insight Expedition (GIX), where we will examine the 2011 “Triple Disaster” (earthquake, tsunami, and nuclear reactor meltdown) and its effect on business, government, and society.

Tuck’s annual Business & Society Conference was also held this week. I helped put together the education panel as well as the conference’s marketing efforts. Once classes were over, I split my day between preparing for the week’s classes/homework, finalizing logistics and marketing for the conference, and catching up with people in the impact investing space (I am recruiting for something unique/specific in the ed-tech venture capital space).

Tuesday

With our Marketing class cancelled so our study groups could work on finalizing our MarkStrat simulation project, I used the extra time in the morning to both sleep in and get in a quick workout before classes. I find that working out before the craziness of the day ensures I actually get it done. It’s the tearing-myself-out-of-bed part that is the hardest.

In our Finance class, we discussed how to use the option-valuation-methodology to decide whether investing in an oil field is worth it. Luckily the girl sitting next to me in class had worked in both investment banking and private equity in the oil industry in Houston, TX before Tuck and could translate everything I didn’t understand (so ... pretty much everything).

After class, I had to make a few recruiting/networking calls and then I met up with my study group to finalize the work on our upcoming final project for Corporate Strategy. Our group chose to look into how education technology companies were disrupting the K-12 education industry and what the possible effects may be both economically and socially.

Later, I met up with my soon-to-be First Year Project (FYP) team for a quick beer at Murphy’s to talk through project goals. FYPs are projects you work on in groups of six during the spring quarter. My FYP team is going to help Tuck design a social venture fund which will look to make early-stage investments in entrepreneurs and track both the financial and social returns garnered by our capital.

To end the day, I went over to a second-year student’s house for a Small Group Dinner. These small group dinners are held periodically throughout the year and offer a randomly selected group of students, partners, faculty members, and staff members to get together and enjoy some home-cooking and “family time.” Our host for the night cooked the juiciest grilled chicken and cheesiest mac and cheese. It was a good thing I went to the gym that morning.

Wednesday

On Wednesdays and Thursdays this term, I am taking Global Economics for Managers—affectionately known as GEM—and Corporate Strategy. This week in GEM we focused on the auto industry in the 1980s. Wednesday’s class gave us a better understanding of how changes in currency exchange rates made the Jaguar a more attractive car to American buyers. During Thursday’s class, we looked at how “endaka”—which the Yen’s soaring appreciation in value and Japan’s reliance on exports—forced Japanese automakers to get creative with their growth strategy in order to survive increasing price competition from American automakers.

In Corporate Strategy we focused on Disney, spending Wednesday examining what makes Disney so special and how it has maintained its top-tier brand value over so many generations (answer: Mickey Mouse). On Thursday, we examined Disney and Pixar before its merger and tried to assess whether Disney made the right move and how Steve Jobs may have used some genius negotiation tactics to push up Pixar’s price.

After class, I attended a lunch with other student organizers from Tuck’s Private Equity and Venture Capital Conference to discuss how we could make next year’s event even better. I spent the remainder of the afternoon catching up on my Hulu queue trying not to get choked up watching the series finale of Parks and Recreation finishing up schoolwork.

On Wednesday night, I attended a dinner with Aly Jeddy D’93, a partner within McKinsey & Company’s private equity practice. I was invited to the dinner along with six second years and one other first year by Professor Curt Welling D’71, T’77. Professor Welling chose us to attend because of our interest in understanding whether there was truly a negative tradeoff between financial and social returns when making venture capital or private equity investments. Aly argued, and we all agreed, there is not—if you invest correctly.

Thursday

After GEM and Strategy on Thursday, I enjoyed some salad in the lunch room catching up with a few friends. One of my future roommates sat down and we started discussing how we might split the different rooms and rent costs for the house we were going to be moving into next fall. With three of our lunch crew having worked in banking—one here in the US, another in Dubai, and the final one in Singapore—the discussion quickly turned to auction and reverse-auction strategies which could satisfy each individual’s preferences and willingness to pay, etc. Just before the laptops and excel models opened up, we changed the topic—thankfully.

I arrived in my final class of the week—Entrepreneurial Thinking—particularly excited about the day’s topic: How Andreessen Horowitz was disrupting the venture capital industry. One study group is chosen each class to discuss their case analysis, usually in front of someone (the entrepreneur, venture investors, etc.) from the case. When I arrived, I saw that our group was chosen to present this week. I thought that was cool, but especially because there was no way someone from Andreessen—which only has one office on Sand Hill Road in Menlo Park, CA—would come all the way out to Tuck for this class. I figured today’s class was the best of days to present because the pressure would be off. Tom Naughton D’89, T’96, our professor and the executive director of Tuck’s Center for Private Equity and Entrepreneurship, began the class by introducing our guest: Scott Kupor, managing partner (CEO) of Andreessen Horowitz.

My heart immediately sank. Sure, I had presented to CEOs before when I was a strategy consultant, but never on an analysis of the company which I had only spent a few hours on. Admitting my nervousness to Scott and the rest of my class, my study group and I walked through what we thought Andreessen was doing well and how it was winning in this industry. Luckily, after we finished, Scott gave us the nod that we had done a good job.

After class, I was chatting with one of my group-mates Justin about how lucky we were to have been selected to present. Here I was looking for a job in the venture capital industry, and here Justin was, starting a company and looking for venture financing. Then it hit us—Tom definitely used his knowledge of our backgrounds and career goals to give us this spotlight in front of Scott.

While there have been many times before when Tuckies went out of their way to help each other out, this was one shining example of a Tuck professor REALLY knowing you and finding a way to help you in your career development. Given that I had experienced something similar just the night before when Curt Welling invited me to the private dinner with Aly, I felt a closeness to Tuck that was hard to describe.

This place truly is a family.

As if my Thursday hadn’t been awesome enough, it was the day before Tuck’s Business & Society Conference. This night, we were lucky enough to host some of our panelists from out of town and treat them to a small group dinner in Hanover. The education panel I helped develop featured Graham VanderZanden, an associate partner from the NewSchools Venture Fund, Tammy Battaglino, co-head of The Parthenon Group’s education practice, and Emary Aronson, head of education investing at The Robin Hood Foundation. While Graham and Tammy were going to drive up from Boston on Friday morning, Emary and her boss, Amy Houston T’97—who also happens to be on Tuck’s MBA Advisory Board—came up Thursday night and joined us for dinner. We discussed how Robin Hood was pioneering metrics that would improve the way foundations make investments in areas such as K-12 education.

Friday

After all the work and planning that went into it, the Business & Society conference was finally here! With over 350 registrants, Tuck was abuzz with people who saw business principles as a conduit for improving society. The event started out with Nancy Pfund, managing director of Double Bottom Line (DBL) Investors, a venture capital firm that looks to maximize both financial and social returns. DBL’s portfolio includes companies like Tesla Motors, Revolution Foods, Pandora, and Solar City.

After the opening keynote, we broke into different panel discussions that were planned throughout the day. Panel topics included corporate social responsibility, education, energy, ethics, health care, and social entrepreneurship. Speakers included people from .406 Ventures, Burton, Cabot Creamery, Deutsche Bank, Freight Farms, Grassroots Soccer, and New Profit.

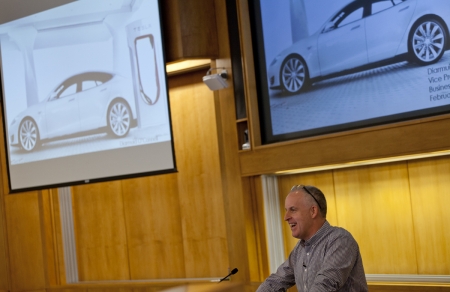

The conference came to a close with a keynote from Diarmuid O’Connell, vice president of business development for Tesla Motors, who talked about the Tesla story, its current projects, the

challenges in battery technology and energy storage, and how Tesla is working to change the world one car at a time. It was a truly amazing way to end what had been a great day.

challenges in battery technology and energy storage, and how Tesla is working to change the world one car at a time. It was a truly amazing way to end what had been a great day.

After a quick power nap that recharged my personal battery, I attended the annual Tuck Suits and Stethoscopes party which is a gathering hosted by the Dartmouth MD-MBAs. It brings together both the business and medical schools for a night of dancing and fun.

Once I finished my story, my fraternity brother said it sounded like I had done more in this past week than he had done during his months of travel in Southeast Asia. A part of me was jealous of all

the free-time he had had to travel, sightsee, and reflect on his own personal journey. But, then again, it was clear from my last week that my Tuck family provides me with all those things as well—just in a different way.

It was a great week. Now it’s time to stop reflecting and study for finals!

(Photo at right: Diarmuid O’Connell, vice president of business development for Tesla Motors, delivers his keynote address at the Business & Society Conference. Photo by Laura DeCapua.)

The Center for Business & Society supports Tuck’s annual student-led Business & Society Conference that brings together leaders from a wide range of fields to discuss the important role that business leaders can play in creating a more sustainable world.