Operations’ Intricate Science

Tuck faculty weigh in on the vulnerabilities in the global supply chain.

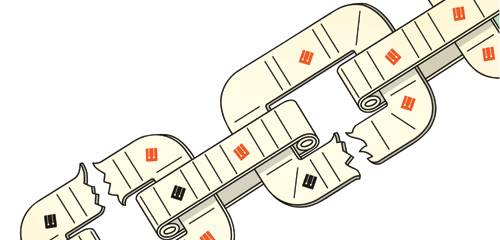

In this age of globally integrated production, people are used to getting what they want. Most consumers, however, have only a vague understanding of the vast networks of suppliers involved in the process. In search of profits and efficiency, companies have made a science of supply chains, connecting networks of suppliers in far-flung parts of the planet in order to build and bring their products to market.

“In the past 10 years, supply chains have become much more global and more disaggregated,” says Brian Tomlin, associate professor of business administration at Tuck. “There are many, many more companies involved between raw materials and consumers, which has created a much more complex supply chain.”

It all works incredibly well—until it doesn’t. Like a breeze from the proverbial butterfly’s wings, a disruption anywhere can send ripples up and down the supply chain, affecting products, companies, and even entire industries. When there are breaks—natural disasters, contamination, labor shortages, or internal coordination issues—it not only wreaks havoc on the production lines of well-known brands, it can also directly affect the availability of products we find on the shelves. Here, four members of Tuck’s operations faculty offer their research-based insights into the vulnerabilities that exist in the supply chain, how they impact consumers, and what firms can do to protect themselves.

Automobile Microcontrollers in Japan

The magnitude 9.0 earthquake and tsunami that hit Japan in March 2011 was a disaster of nearly unfathomable proportions. In addition to the damage at the Fukushima-Daichii nuclear power plant, the quake hurt factories that produce electronics and other goods. While the major Japanese automobile manufacturers emerged from the tragedy relatively unscathed and were able to resume production in short order, their recovery was limited by damage to just one critical link in the supply chain.

Most vehicles produced today are rolling computers. Every vehicle brought to market now has about 100 tiny computer chips called microcontrollers that run everything from airbag deployment and engine control to the on-board navigation system. Luxury vehicles have about double that. And many are made in a single plant by a single company: Renesas Electronics. Through consolidation and technological innovation, Renesas has managed to corner the market on automotive microcontrollers, producing 40 percent of them worldwide. The jewel in the company’s manufacturing system is its Naka plant, located just north of Tokyo, which also bore the brunt of the earthquake’s wrath.

“What happened is that the earthquake shook the building and dislocated one wall from the rest of the factory,” says Margaret Pierson, an assistant professor of business administration at Tuck, who co-wrote a case study on the company last year. While that might not seem like major damage, consider that the complex microchips in automobiles are manufactured in an environment cleaner than your standard hospital operating room. One small piece of dust in the wrong place can ruin a production run. “You can imagine what it means when a wall is knocked off,” Pierson says. Following the earthquake, the building had to be repaired and the clean room environment reestablished before the machines could be turned back on and damage to these tools assessed. The tools were then recalibrated and test runs of product were created before Naka could begin to fill orders again.

Many major automotive manufacturers relied heavily on Renesas and were hit hard by shortages. In Japan, Nissan lost $434 million, Honda $550 million, and Toyota $1.2 billion, suffering a four-point loss in market share as plants sat idle waiting for the crucial components. (Renesas itself posted a loss of nearly $800 million in 2011.) Shifting production to another plant until Naka got back on line wasn’t feasible for some of the products manufactured there. “Every time there is an upgrade in technology the chip size is reduced and the production lines at Naka were the most advanced within Renesas,” explains Pierson, “the production equipment costs increase because the production processes must be performed on a smaller scale, requiring more sensitive tools.” A factory like Naka might need hundreds of tools costing in the neighborhood of $1 million each, along with a few costing upwards of $50 million. This puts the total value of a single production line close to $1.5 billion, as Pierson notes in the Harvard Business School case, “Renesas Electronics and the Automotive Microcontroller Supply Chain.”

“It may not be feasible to duplicate all that equipment across two facilities, even though a backup option would certainly have been very helpful following the disaster,” says Pierson. “By late 2011 many boards were taking a fresh look at these cost tradeoffs.”

While Renesas mounted a tremendous recovery effort, manufacturers were faced with hard choices as they experienced short-term inventory shortages. In many cases, they sacrificed optional components such as navigation systems, making them scarce for consumers. The companies that fared the best had designed their vehicles such that they could use the same parts across many models—allowing for flexibility in which models they produced when their inventory of parts became limited. Similarly, companies that invested in more backup inventory had an easier time managing the supply disruption.

Flexibility and inventory both play a role in risk management, adds Brian Tomlin. “There is a trade-off between cost and resiliency. Companies need to ask themselves, ‘How resilient do I want to be versus how cost-efficient do I want to be?’” In cases where companies can source components from multiple suppliers or rely on backup suppliers in times of emergency, it might make sense to keep inventories low. However, when companies rely on very specialized or expensive parts, they do so at their peril. “What really good companies do is look at the various components in their supply chains and ask if they can be reasonably sure they can rely on a backup,” he says. “If they can’t, they better invest in some inventory.”

Disk Drives in Thailand

The 2011 fall monsoon season saw the worst flooding in Thailand in 50 years. More than two-thirds of the country was inundated in the deluge, which destroyed ancient temples, disrupted rice production, and shuttered hundreds of factories. The computer hard drive industry was hit particularly hard. Over the past decade, drives have become increasingly more commoditized, so companies have specialized in particular components. These were assembled by a series of subcontractors. With such an interconnected production process along the supply chain, it made sense from a cost and efficiency perspective for the companies to be situated near one another. At the time of the floods, nearly half of the hard drives in the world were produced in Thailand, and most of them by two companies: Seagate and Western Digital. (Shortly before the floods, the two companies had announced a planned acquisition of the hard drive units of their largest competitors, Samsung and Hitachi, though these deals were not completed until later the same year.)

The same consolidation that led to efficiency, however, also made the industry vulnerable to large-scale disruption. Dozens of factories were submerged or lost power, paralyzing crucial segments of the supply-chain. One single industrial park near the ancient Thai capital of Ayutthaya was home to a half dozen separate subcontractors; when power was knocked out, the government ordered a mandatory evacuation, bringing production to a halt. Disk drive prices doubled as output shrank by 30 percent, just in time for the Christmas retail season. Some computers were simply unavailable, while others increased in price, and the effect spread to other companies, such as Google, which relies heavily on hard disk storage. While the price increase has since plateaued to a 10¬–40 percent jump, it is not expected to return to pre-flood levels until 2014.

Making the situation worse, says Pierson, was a phenomenon she calls “recovery congestion.” Just as companies compete for customers and suppliers, they also compete for resources when disasters occur. “There is a limited amount of emergency assets, such as diesel generators and construction equipment, as well as a limited infrastructure over which to move these assets around,” says Pierson. “As factories become concentrated in one place, they compete for necessary resources for recovery when a disaster occurs. In the case of Renesas in Japan, many automotive companies as well as the tool manufacturers, were able to assist in the plant’s recovery efforts. In the case of the Thai floods, Western Digital’s assembly lines were damaged as well, so they did not have the same ability to assist in their suppliers’ recovery efforts.”

In this case, Seagate was better able to weather the storm. Not only had it acquired a firm that operated outside the region, but its manufacturing plant in Thailand was located on higher ground less affected by the rising waters. In the last quarter of 2011, Seagate shipped more than double the number of hard drives than its rival—some 47 million compared to 29 million—allowing it to pass WD as the number one firm in the market. “This competitive upside to being able to recover faster can be difficult for firms to forecast,” says Pierson, “but following these and other recent supply chain disruptions many firms are taking a second look at their supply chains not just as a cost center but also as a source of strategic advantage.”

Mattel in China

Supply-chain disruptions don’t just affect the availability of products. They can also have an impact on quality. Such was the case in 2007 when a child became sick from lead poisoning after playing with a toy car produced by Mattel. The toys were eventually found to have contained nearly 200 times the legal limit for lead, and the company was forced to recall more than 18 million toys worldwide for toxic components and other problems. Seemingly overnight, Mattel went from being the most respected toy company in the world to the least. Angry and concerned parents steered clear of Mattel products in the run-up to Christmas and the company posted a $30-million loss for the quarter.

M. Eric Johnson, associate dean for the MBA program and Benjamin Ames Kimball Professor of the Science of Administration, says Mattel should have known better. “Mattel had been in China long before it was cool,” says Johnson. “They [had been there for] 25 years, and had deep, deep experience working in the country.” The problem, he says, was that the firm had slowly changed its model of manufacturing over time. When Mattel first entered China, it was strictly as an assembly operation for materials sourced from all over the world. Eventually, multinational suppliers relocated to China to be closer to the parent company. Then, slowly, Chinese firms developed to source the material. Finally, Mattel outsourced the assembly as well.

In the end, all it took was one subcontractor to undermine the entire chain. Mattel had given its subcontractors in China a list of eight approved companies it could use for painting. But in an effort to lower costs, one subcontractor employed an unauthorized supplier that used the lead-based paint for the production of one specific toy—a Hot Wheels car based on a character from the Disney movie “Cars.”

“You can always point to the vendors, but in the end it was Mattel’s problem,” says Johnson, who has visited Mattel’s factories in China and leads Tuck MBA students in an annual tech-toys ranking. “The problem was the game had changed over time, but management methods were still trapped in an earlier time. That’s a common story with large companies, where risks creep in without constant due diligence to look at what is changing.”

In such cases, institutional inertia is often caused by a structure that fails to delegate direct responsibility to any one person or department. And without direct oversight, it’s easy for individuals to overlook obvious problems with the excuse that “it’s not my job.” While Mattel pledged to increase monitoring following the incident, some companies are going a step further and anticipating quality control breakdowns before they occur. Food distribution giant Sysco, for example, routinely holds “Black Swan Meetings” (named after the book by Nicholas Taleb about unlikely but catastrophic events) to identify weaknesses in the supply chain.

To underscore the point, the company holds the meetings on Friday the 13th, and encourages everyone in the room to brainstorm the direst scenarios—no matter how unlikely—so that executives can walk backward to make sure proper safeguards are in place. “It almost seeks a gimmick, but the idea is giving a name to something that otherwise would go unexamined,” says Johnson. “Sometimes these risks are nobody’s job and everybody thinks someone else has it covered. The ‘Black Swan’ idea is aimed at trying to change that kind of thinking.”

Pharmaceuticals in the United States

Supply chain quality-control issues are not limited to subcontractors in developing countries. There have been several major incidents in the United States in the last few years that have had a profound impact on the health of thousands of people. In 2009 biopharmaceutical company Genzyme discovered that a virus had contaminated production of three of its drugs at a plant in Allston, Mass. Two of them, Cerezyme and Fabrazyme, were the only drugs approved by the Food and Drug Administration for Gaucher and Fabry diseases, genetic disorders that can affect metabolism and cause extreme joint and bone pain and bodily deformities. In the previous year, the two drugs accounted for more than a third of Genzyme’s revenues ($1.7 billion of $4.6 billion total), and closure of the plant amounted to nearly $600 million in losses for the company. More crucially, because this was the only plant in the world that produced the drugs, thousands of patients would now go without treatment for their diseases.

“The economics of pharmaceuticals doesn’t lend itself to having an idle plant that might be used when needed,” says Brian Tomlin, who used Genzyme as an example in a book he wrote on supply-chain risk.” At the same time, because it’s extremely important for pharmaceuticals to be uniform wherever they are produced—both for quality control and regulatory reasons—it’s difficult to have a second plant to simultaneously produce the same drug. “For FDA approval, you need to show that the process is identical. Otherwise you run the risk that there are enough differences that you need to sell it under a different label.”

As with car manufacturers in Japan, Genzyme had covered itself with an inventory stockpile in the event of a shortage. At the time, however, the company had made the decision to ramp up production of another drug in the same plant, leading to a smaller backup supply of the contaminated drugs. And since the stockpile was also held in the same facility, the company also had to prove that the backup inventory hadn’t been contaminated by the virus before it could release it to the market. In order to compensate for the loss, Genzyme communicated with doctors and patients to direct the drug to patients that needed it the most, and to sign up other patients for clinical trials of another experimental drug. In the meantime, the FDA had fast-tracked the approval of other drugs produced by two of Genzyme’s competitors for the same diseases. “The long-term implications of the disruption was that it created a much more competitive environment for Genzyme,” says Tomlin.

The example highlights not only how fragile the supply chain can be, but also the limited recourse companies sometimes have in the case of a disruption. While inventory helped to offset the losses to some extent, it’s nearly impossible to have enough of a stockpile on hand for the worst-case scenario. In 2010, Johnson & Johnson also faced a plant closure of one of its plants in Pennsylvania that produced Tylenol and other over-the-counter drugs; due to scope of the problem, that plant isn’t expected to reopen until 2013. “Even the most conservative company is not going to hold three years of inventory,” says Tomlin. Other strategies, such as insurance for business disruption, won’t compensate a company for certain issues— like viral contamination—and even if they did it couldn’t make up for market share lost to an opportunistic rival. “The nightmare scenario is when I am interrupted but my competitor is not,” says Tomlin.

Airlines, Call Centers, and Health Care

When we think of supply chains, we’re likely to picture physical networks of production with some kind of tangible good as an end product. As we move to an increasingly service-based economy, however, equally complex networks are developing in order to deliver services as well.

Take airlines. Since the emergence of low-cost carriers such as Southwest, larger airlines have been relying more and more on alliances and code-sharing with other airlines in order to compete, oftentimes concentrating on long-haul flights and relying on regional partners for shorter trips. Depending on the number of connections, it is possible that a passenger will be served by two or more different airlines on a single trip. But as anyone who has ever booked a flight online knows, prices can vary dramatically depending on date, time, and carrier. For the airlines themselves, such differences are even more crucial as they negotiate how to share the proceeds from a particular flight. While it might make intuitive sense for the companies to split the profits according to the miles flown by each carrier, in reality that might lead to unfair arrangements, such as when a United flight from Rochester to JFK is near empty and a Lufthansa leg from New York to Berlin is packed.

“If either partner doesn’t get enough revenue sharing, they might save the seat for their own passengers,” says Rob Shumsky, a professor of operations management at Tuck who has researched the airline industry. The implications for that might trickle down to consumers, he says, both in the availability of flights to some destinations and in the price they ultimately pay for their tickets.

Customer service call centers are another service supply chain that can have a significant impact on consumers. We all know that, to reduce costs, many firms have established call centers in developing countries such as India. What you may not know, however, is that the arrangements companies have with their subcontractors may have a dramatic effect on the service you receive. “You might call for tech support, and unbeknownst to you, the first people you talk with are from an outsourced call center, but if they can’t solve your problem, you might be transferred to an engineer employed by the original manufacturer in a different country,” says Shumsky.

For companies, there is a risk in having so many links in the chain dealing directly with consumers, requiring a trade-off between cost and quality. “If you just put the emphasis on quality, then costs can skyrocket,” says Shumsky, citing cases in which customer service representatives are incented not to escalate calls to more experienced—and costly—engineers. “If you’ve ever gotten frustrated with people not letting you talk to the people who actually know what they are doing, then it may be because of how that contract was written,” says Shumsky.

An even more crucial example of the importance of service supply chains can be found in health care, where the increasing complexity of the system has led to rampant specialization, while efforts to contain costs have led to a bewildering level of subcontracting. “If someone is having a heart attack on the sidewalk, I have counted at least nine different independent organizations involved in getting that person to a hospital bed,” says Shumsky, including the ambulance company, the hospital, the emergency service (which some hospitals outsource), the radiology lab, and independent physicians. “And that’s not even counting the people who serve meals and do laundry. You have an incredibly elaborate web.”

Without proper coordination, the results can be tragic. When that happens Shumsky says the tendency is for people to focus on a weakest link, be it administrators or health care providers, “because we tend to personalize problems with services,” says Shumsky, who teaches in Dartmouth’s Master of Health Care Delivery Science in addition to the Tuck MBA program. “But I believe that the underlying problem is that there is no organized system that coordinates the activities in the supply chain.”

Shumsky is hopeful that innovations such as the creation of accountable care organizations, which organize groups of health care providers to work together, will help matters. “The idea is to coordinate them so they’ll have the same incentives in cost rather than thinking about what is the highest bill they can get from this procedure,” says Shumsky. In practice, however, this is easier said than done—technological and cultural differences, hierarchies, and historical antagonisms all contribute to barriers between providers that get in the way of good care.