Research

Reverse Innovation is an important book.

– Indra K. Nooyi, Chairman and CEO, PepsiCo

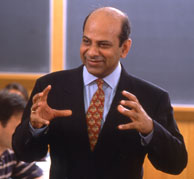

Teaching

Lessons I learned 15 years ago in his class I still carry today. He is a truly gifted teacher.

– Anil Chitkara, T '94

Speaking

VG shows how to turn breakthrough ideas into breakthrough growth.

– John Menzer, President and CEO, Wal-Mart International

-

TEDX Big Apple on Reverse Innovation -

Tea With The Economist -

Thinkers 50 Awards -

World Business Forum -

VG and Prime Minister Singh

Contact

Tel: 603-289-0007

vg@dartmouth.edu

VG personally handles all inquiries. The best way to reach him is his email address. Only as a backup, use VG’s cell phone: 603-289-0007.

Recent Blog Posts

- How Should Companies Prepare for Debt-Ceilings Standoffs

- Tuck GLP

- Does Your Company Have an India Strategy?

- Recent Technology Layoffs, CMR

- HBR Special Issue

- Business School in the Metaverse: Part 2

- Tech Talent Is Flooding the Job Market

- VR is a game changer

- IMS Lifetime Achievement Award

- The Unicorn Within: How Companies Can Create Game-Changing Ventures at Startup Speed