The Strategists

There are many paths to the top and Tuck’s renowned strategy professors know them all.

There are many paths to the top. Tuck’s renowned strategy professors know them all, and are learning new ones every day.

Strategy is an old word but a modern phenomenon. Its etymology is traced back to the Greek strategia, which is best translated as “generalship.” The military connotation is strong and intentional, because for most of history strategy meant the “art of war.” Militaries still have strategies today, of course, but the difference is that everyone else does too. We have career strategies, parenting strategies, weight-loss strategies. The term has been coopted so often that we barely know what it means anymore. But if you peel back the layers of interpretation, you can still find its core. The British military historian Sir Lawrence Freedman calls it the “art of creating power,” and reminds us that strategy needs conflict like fire needs air. Strategy is therefore imbued with drama. It is the story of the leader trying to hold on to the lead, or of the underdog scratching its way to the top. Strategy is about figuring out how to win.

So it’s surprising that strategy wasn’t applied to the business world—a cauldron of competition—until the 1960s, with the publication of Igor Ansoff’s book “Corporate Strategy,” and Boston Consulting Group’s offer of strategic consulting. Ansoff, who is now called the “father of modern strategic thinking,” had recognized like many others that the business environment had become stunningly complex, creating the need for rational decision-making processes that could guide corporations. Business schools agreed, but didn’t immediately adopt Ansoff’s vocabulary. At Tuck, the course on how to lead an organization through a difficult, dynamic, competitive landscape was called Business Policy, and it was developed and taught by the legendary professor James Brian Quinn. Quinn was the ideal person for the task; he was a Renaissance man, a generalist who could teach a case where the issue was operations, or finance, or marketing. He taught at Tuck from 1957 to 1993, a time of revolutionary technological change, and became a leading thinker on the intersection of strategy and technology.

Quinn’s era, where strategy meant a broad application of business principles at high levels of management, has since transformed into an era of increased strategic specialization. That’s true at Tuck, but the mission of the school is the same as it has always been: to be the best leadership education program in the world, with a faculty of thought leaders. So when it comes to strategy, Tuck’s mission is reflected in the strength and diversity of the professors in the strategy group. “Tuck has a strong general management reputation,” said Dean Paul Danos. “Our students become CEOs, business owners, leading consultants, and part of that has to do with our strategy group, which is very eclectic. Students get a variety of perspectives on this complex topic so they can create their own approach to business strategy.”

Govindarajan got his first chance to test that theory when he was hired to teach at Harvard Business School. He had attended HBS on a Ford Foundation fellowship, which stipulated that he spend two full years in India after he graduated. The job offer from Harvard required him to start in Cambridge just one week shy of the end of the two-year commitment. He took the job anyway, which meant he had to reimburse the Ford Foundation the money it spent on his education. The debt didn’t sit well in his mind. He and his wife made sacrifices. They lived in a third-floor walkup, didn’t buy a car, bought used furniture. Then the dean of the business school gave him an idea to make some extra income: try consulting. His first client was BF Goodrich, and he enjoyed the opportunity to get inside a company, learn their struggle, and help them think it through. “It made me a better professor and it gave me ideas for research,” he said. “Other academics lacked that access, and I liked it.”

For the past 35 years, Govindarajan has worked with leading companies to learn how they’re solving problems nobody else has figured out, and he’s written best-selling books that share their wisdom. This is what is known as the “next practice”—a procedure or approach that only 10 percent of companies have adopted, but which gives them a strategic advantage. As a researcher and author, Govindarajan’s task is to find the “next practices” out there, test if they really are significant, and then show how other companies can implement them in their own businesses.

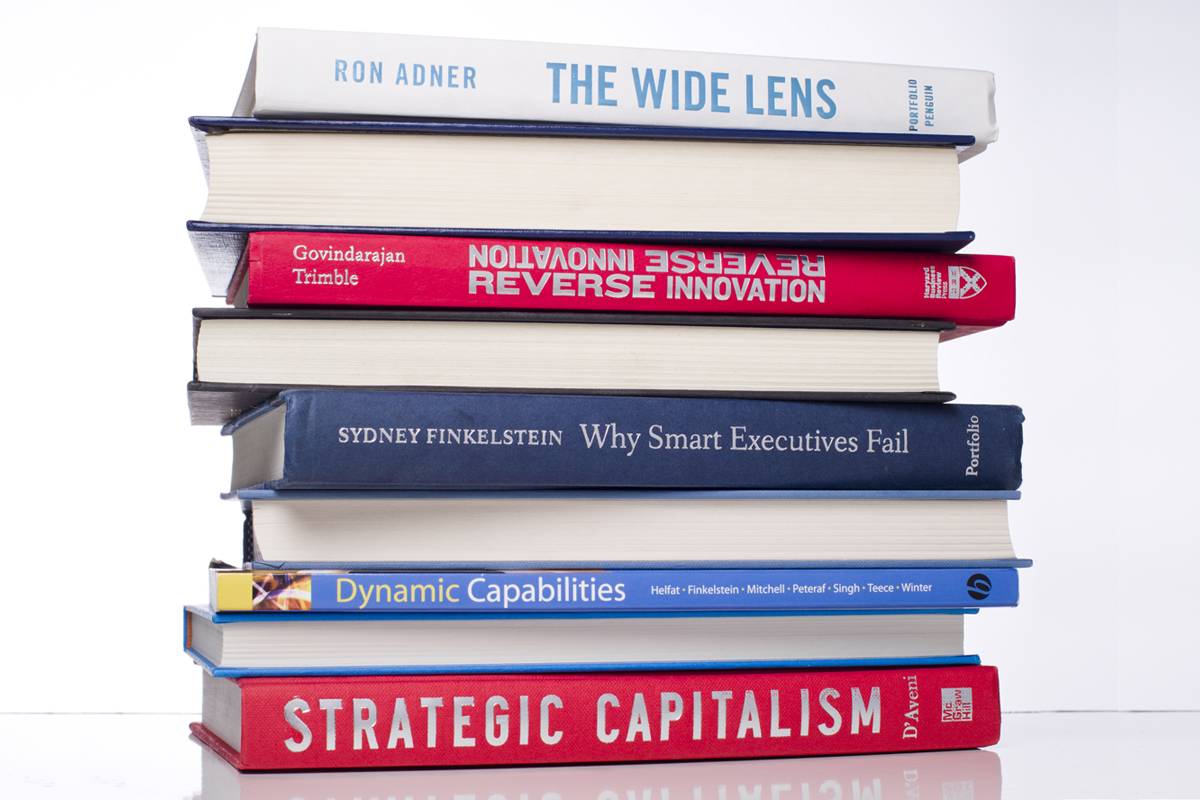

The most profound “next practice” that Govindarajan has discovered is something he calls reverse innovation, which is also the title of his 2012 book. Reverse innovation is the process of developing new products for the needs of underdeveloped and emerging economies, and then bringing those lessons and innovations back to the wealthier parts of the world. He made this discovery while consulting closely with General Electric, noticing that it had developed a $5,000 portable ultrasound machine for poor areas in China (in the United States, a similar machine costs $300,000), and then sold it to scores of other, richer countries. GE had done a brilliant thing, but its lesson was lost in the enormity of the organization. Govindarajan shared his insight with GE’s CEO, Jeffrey Immelt D’78, who made reverse innovation a top priority for the company the following year.

“I am inspired by practitioners,” Govindarajan said. “I live in the world of ideas, but for me, ideas come from practitioners.”

So D’Aveni set out to write a book about what happens in highly disruptive environments with constant changes, where competitive advantages disappear overnight and new ones take their place. To begin he set up four card tables in his basement, each one representing a different competitive advantage—product positioning, resourced-based (know-how and timing), barriers to entry, and size. Then, like a grand chess master, he made an opening move, and followed with counter moves. He realized that each new competitive advantage would destroy the prior ones, if firms were playing to win. At the end of the process he discovered something he called “escalation ladders.” Rather than trying to decrease rivalries (as suggested by Michael Porter’s Five Forces Theory), the successful strategy was to continually trump the previous move—through things like redefining quality, circumventing barriers to entry, revolutionary new resources, and building war-chests to destroy the strongholds and advantages of rivals. D’Aveni describes these strategies, and how companies can use them, in his now classic, global best-seller “Hypercompetition: Managing the Dynamics of Strategic Maneuvering” (1994).

In recent years, D’Aveni has widened his focus on hypercompetition from domestic firms trying to disrupt the status quo to multinational businesses competing for turf and, ultimately, nations competing for world economic dominance. In 2001, he published “Strategic Supremacy: How Industry Leaders Create Growth, Wealth, and Power Through Spheres of Influence,” which explained how established firms could restructure their global portfolios around core markets, and then create buffer zones and forward positions that would disrupt rival spheres of influence, and affect the balance of power among global competitors. Continuing to expand his application of hypercompetitive strategy, D’Aveni published “Strategic Capitalism: The New Economic Strategy For Winning the Capitalist Cold War” in 2012. This book argued that China’s economic strategy was based on hypercompetitive principles leading to the disruption of the national advantages of the U.S. economy, and it set out economic and geopolitical strategies designed to turn the tables in favor of U.S. economic preeminence.

Using the principles from his three books, D’Aveni teaches two electives in the MBA program: Advanced Competitive Strategy and Global Strategy. He brings 10 to 12 Fortune 500 CEOs to Tuck every year as guest lecturers talking about the core concepts of hypercompetitive strategy: market disruption and the use of temporary competitive advantages.

D’Aveni has recently turned to applying his hypercompetitive notions to what he considers to be the next big move available to manufacturers: 3D printing, which he calls “the perfect hypercompetitive device.” Why? Because it could destroy China’s competitive advantage by doing away with the need for assembly plants based on low-cost labor. Instead of products being made in China and shipped around the world, they could be 3D-printed in the countries where they’ll be used. “It will change the balance of trade,” D’Aveni said. “The faster 3D printing comes into place, the better off we’ll be.”

Some strategy thinkers latch on to the fact that technological change can spell failure for established firms, and they examine the reasons for those failures. Helfat, who’s been teaching at Tuck since 1998, is broadly interested in discovering and understanding the capabilities that make firms successful. “Instead of focusing on the problems, I focus on solutions, and how firms create opportunities for themselves,” she said. “It’s a glass-half-full strategy.”

And why do firms succeed? Through her research, Helfat has come up with quite a few factors, but a major one is a firm’s dynamic capabilities, or how well it accomplishes strategic change. In 2007, Helfat collaborated with Tuck professors Margaret Peteraf and Sydney Finkelstein, and others at other institutions, to write the book “Dynamic Capabilities: Understanding Strategic Change in Organizations.” The authors define “capability” as the “ability to perform a particular task or activity.” A dynamic capability is oriented toward changing the current condition of a business, or, as they state, to “purposefully create, extend or modify its resource base.” Basically, how to grow or survive in a constantly changing world.

While sketching out the contours of dynamic capabilities in general, Helfat has spent a lot of time researching the building blocks of those capabilities, from superior R&D to integrative skills like communication and coordination, which allow companies to pursue strategies such as vertical integration, product diversification, and joint ventures.

Along this line, in a 2009 paper she wrote with Alva Taylor, an associate professor of business administration at Tuck and the faculty director of the Glassmeyer/McNamee Center for Digital Strategies, Helfat developed a conceptual model that explains why some firms survive technological transitions well. They identified four influences—economic, structural, social, and cognitive—that allow a company to shift to a new technology while using “valuable preexisting capabilities,” focusing on the critical role of middle managers in linking the old with the new.

More recently, Helfat has been digging even deeper—into the “microfoundations” of dynamic capabilities. In a forthcoming journal article, Helfat and Peteraf examine the cognitive underpinnings of skills that make managers adept at handling change. They focus on several managerial cognitive capabilities: sensing and seizing opportunities, which require perception, attention, and problem solving; and reconfiguring and orchestrating assets, which necessitates skills in language, communication, and social interaction.

“The mental processing of information has been underemphasized in strategic management, but managers’ cognition is very important,” Helfat said. “The way you think about things affects what you do.”

Finkelstein, the Steven Roth Professor of Management and associate dean for Tuck Executive Education, started his academic career with traditional research for peer-reviewed journals on topics such as executive compensation, top management team tenure, corporate governance, and the role of the CEO in a firm’s success. About 15 years ago, he felt the desire to speak to a much bigger audience and to take on messier questions, such as why people do stupid things and why organizations fail. For these questions Finkelstein had no hypothesis. It was inductive research, which involved interviewing many people, collecting loads of data, then trying to find the patterns and tell the story. “It’s hard to do, but it’s the most fun,” he said.

The first product of that new method was the 2003 best-selling book “Why Smart Executives Fail,” the most in-depth investigation to-date on the phenomenon of corporate failure and managerial mistakes. Through 51 corporate case studies, Finkelstein found that all corporate failures fit into four categories: new business breakdowns, choosing not to cope with change, misguided mergers and acquisitions, and new competitive threats. Six years later, Finkelstein followed up that book with “Think Again” (co-authored by Jo Whitehead and Andrew Campbell), which used research from neuroscience, cognitive psychology, and management to take a closer look at managerial decision-making. They discovered that bad decisions have two parents: a judgment error by someone in power, and the failure of others to identify the error and correct it before it’s too late. These flaws, in turn, were traced back to cognitive biases that trick our brains into making false judgments, and the lack of a system to help executives slow down and think through complex decisions. “We’re funny,” Finkelstein said. “We don’t like to be criticized, we procrastinate, we don’t want to try new things. These human tendencies can get you into a lot of trouble when you’re a CEO.”

Finkelstein brings these lessons into his classrooms—he teaches the core course Analysis for General Managers, and the elective Strategic Leadership—and gives students the opportunity to put themselves in the position of a CEO making a decision. “We focus a lot on diversity and self-awareness,” he said. “Are you ignoring an emotional bias? Do you have a diverse team that deliberates and makes careful decisions?”

If strategy comes from people, and not amalgams known as corporations, then it makes sense that a firm’s longevity is based on finding and training the right leaders. This topic—talent development— is the subject of Finkelstein’s next book, which will be published later next year. He’s not saying much about it yet, but expect the same hard-won insights from Finkelstein’s previous books, and the opportunity to assess whether your boss is really interested in developing your career.

That managers manage firms is a given. To Gavetti, managers must also “manage” their own and other’s mental processes. In the vein of Helfat and Finkelstein, Gavetti sees the manager’s mind as one of the true keys to strategic success. The paper that best lays out Gavetti’s theoretical approach is “Toward a Behavioral Theory of Strategy,” which appeared in the journal, Organization Science, in the beginning of 2012, when Gavetti was an associate professor at Harvard Business School. In it, he explores the idea that superior business opportunities are “cognitively distant.” That is, they are not found in the familiar places with familiar patterns of thought. Instead, to grasp the truly innovative ideas, managers must go beyond the bounds of rationality to a place where metaphor and associative thinking can happen. This is challenging because, as Gavetti writes, “it is necessary to deal with substantial ambiguity in order to spot [superior opportunities] and grasp their nature.” One solution, Gavetti believes, is to deploy the reasoning mechanism of analogy, something well suited to “decision-making when ambiguity and complexity are high.”

Gavetti’s favorite example of innovation by analogy is the origin story of Merrill Lynch, which he touches on in his 2005 Harvard Business Review article, “How Strategists Really Think.” Merrill Lynch, one of the biggest banks for most of the 20th century, grew out of a time, before the Great Depression, when banks were only for the rich. But Charlie Merrill had an experience that allowed him to envision something much more democratic. He had been an executive at a large grocery store, and then began to wonder why a bank couldn’t be more like a supermarket, offering a wide range of products for everyone. Merrill had performed a feat of associative thinking: he recalled a situation in his past, paid attention to select features of it, and used those patterns to understand the present.

One of Gavetti’s goals is to show managers how to use associative thinking in a disciplined, systematic way, so it can be deployed on a regular basis to find new opportunities. He is also working to understand the cognitive underpinnings of persuasion. If a strategist spots a business model that is truly cognitively distant and cannot be seen by most competitors, she will also have a hard time getting her own people to see it, and perhaps the capital market to see it. How to get critical audiences on board is therefore critical to the pursuit of strategic opportunities that are cognitively distant.

Gavetti, who won the Class of 2011 Teaching Excellence Award in 2014, introduces students to these topics in his elective course, Psychology of Strategic Leadership. “If we really want to understand and control mental processes, we must go through them firsthand,” he said. “So I create an environment where people experience their own biases, see what it’s like to control someone, and feel psychological safety.”

A vivid example comes from his critically acclaimed book, "The Wide Lens: What Successful Innovators See that Others Miss." In the early 1990s, Michelin invented the run-flat tire, and it was supposed to revolutionize the automobile industry and the driving experience. No more dangerous blow-outs, no more roadside despair. Michelin struck agreements with the likes of Audi, Honda and Mercedes to include the tires as standard equipment on certain models. All was shaping up spectacularly, except for one thing: most tire service centers were not equipped to change or repair run-flats, leaving customers with little choice but to replace the tires at great expense. Lawsuits and other problems mounted. “What had started as an ‘inevitable success’ ended as a massive corporate write-off,” Adner writes. Michelin’s key failure: not understanding the importance of other players in the success of its innovation.

Before Adner created a framework and a grammar for the nature of innovation ecosystems, traditional strategic principles paid partnerships little mind. The resource-based view instructed companies to learn what they did best, and focus on that. The positioning theory centered on understanding the competition. Another school of thought said to cater to customer needs. “The problem,” Adner said, “is that you can do well with all three of those, but if you don’t align your partners, you could still fail.”

At Tuck, Adner is a popular teacher and mentor, and the winner of the Class of 2011 Teaching Award in 2011. He teaches the electives Entrepreneurship & Innovation Strategy, and Strategy in Innovation Ecosystems, a Research-to-Practice seminar. He also consults with corporations on ecosystem strategy and regularly melds his research, teaching and advising together. “What I do in one I can bring to the other,” he said. The ecosystem approach works there, too.

That wasn’t the case with Andrew King, a professor of business administration at Tuck. In the wake of The Innovator’s Dilemma, King and co-author Chris Tucci published two articles testing the disruption theory and showing its flaws and limited predictive power. The first of these articles, “Can Old Disk Drive Companies Learn New Tricks?”, was published in 1999 in the Proceedings of the Product Development Management Conference. It directly tested the theory in the same context Christensen had used to prove it: disk-drive producers in business from the 1970s to 1990s. The paper showed that most of Christensen’s claims didn’t stand up: Incumbent firms were not late to enter new markets, they were more likely to be successful than entrants, and strong firms survived and even dominated across multiple markets.

In a second, more theoretical paper published in 2001 in Management Science, King and Tucci developed and tested a rival theory that the choice to enter new markets was based on production experience: those with greater experience tended to enter new markets, while those with lesser experience tended to play out their hand. Based on a quantitative study of 200 firms, they showed that this normal process of strategic choice and competitive selection explained the history of the industry.

Andrew King is an unusual scholar to be taking on Christensen’s theory, because it is quite far from his main research interests in sustainability and industry self-regulation. It was only when the theory of disruption expended into these realms that his curiosity was piqued. In the late 1990s, scholars and pundits began to argue that firms should pour money into products for the poorest people in the world—the so called “base of the pyramid”—because this represented the next disruptive market. Such investments were supposed to be the ultimate triple win: increasing first-world profits, raising living standards, and simultaneously alleviating pressure on the natural environment. “I was skeptical of such a magic bullet,” King said, “and so I decided to look into the theory on which it was based.”

King and Tucci’s papers made a stir among academics, but popular ideas about the abundance of disruptions and win-win opportunities proved too well ingrained to be debunked by inconvenient facts. “We convinced most top scholars of industry evolution, and that helped me get a job at Tuck,” King said, “but most people remained infatuated with idea of marvelous disruptive innovations. Perhaps that is finally changing. Jill Lepore has a large following, and her article may cause to people reconsider the evidence. My job as a scholar, as I saw it, was to test the predictive power of the theory. Once I had an answer, I went back to my main area of research.”